|

||||

|

Economic Insights from Dr. Sherry Cooper – May 2023

Economic News Jag Dhamrait 1 May

Economic News Jag Dhamrait 1 May

|

||||

|

Mortgage Tips Jag Dhamrait 26 Apr

|

||||

|

Mortgage Tips Jag Dhamrait 4 Apr

|

||||

|

Economic News Jag Dhamrait 10 Feb

Even bond traders and economists are stumped about what the next few years will bring. The repercussions of a global economy that stopped suddenly, shed millions of jobs and initially contracted 30% only to rebound in a flash on the back of free-money government programs are still being felt.

Predicting where the economy goes from here risks taking comfort in spurious accuracy. We’ve never experienced a similar set of circumstances. With hindsight, we now see that policymakers have made severe errors—taking interest rates to unprecedented lows and flooding the system with massive fiscal stimulus has precipitated global inflation; home prices in Canada surged 50% in the three years following the pandemic; variable-rate mortgages were much cheaper than fixed-rate loans as the central bank cut overnight rates to 25 basis points.

The volume of mortgage originations surged, with a record proportion, in VRMs. Now many borrowers have hit their trigger points. The banks allow the amortization of rising interest payments owed, easing the near-term pressure on borrowers. Those with adjustable-rate loans have seen their monthly payments rise seven consecutive times, with likely another rate hike next week. This, in addition to inflation, has reduced household purchasing power. Many are hoping that interest rates fall to pre-COVID levels soon.

Initially, the central banks argued that inflation was transitory. Many are betting that the old forces that worked to keep inflation under control for years would reassert themselves. The federal banking regulator is now proposing additional restrictions on mortgage lending to highly indebted households.

We hope for the best but must prepare for a slow return to 2% inflation. Home prices have fallen but are still up more than 35% from pre-pandemic levels. Labour markets are still robust, but a slowdown is inevitable. This will be a transition year with little likelihood of interest rate cuts. The Bank of Canada will pause soon to see if the lagged effects of higher rates further reduce inflation. Few believe the 2% target will be hit this year or next. The benchmark policy rate, now at 4.25% will not return to its pre-COVID level of 1.75%.

Mortgage Tips Jag Dhamrait 15 Jan

There are many insurance products when it comes to your home, but not all are created equal. One such insurance policy that potential homeowners may encounter is known as “title insurance”.

This particular insurance is designed to protect residential or commercial property owners and their lenders against losses relating to the property’s title or ownership. In fact, it is so important to lenders that every single lender in Canada requires you to purchase title insurance on their behalf. It is not a requirement to have coverage for yourself, but that doesn’t mean you should dismiss it outright.

While title insurance can protect you from existing liens on the property’s title, the most common benefit is protection against title fraud.

Title fraud typically involves someone using stolen personal information, or forged documents to transfer your home’s title to him or herself – without your knowledge. The fraudster then gets a mortgage on your home and disappears with the money. As the old adage goes: “It’s better to be safe than sorry” and the same goes for insurance.

Similar to default insurance, title insurance is charged as a one-time fee or a premium with the cost based on the value of your property. This insurance typically runs around $300 for the lender and $150 for the individual. It can be purchased through your lawyer or title insurance company, such as First Canadian Title (FCT).

If you are wanting to know more about title insurance, or confirm that you (and your home) are properly protected, don’t hesitate to reach out to me today for a mortgage review!

Mortgage Tips Jag Dhamrait 10 Jan

The holidays are a season of giving and often times, households can often find themselves carrying some extra debt as we enter the New Year.

The holidays are a season of giving and often times, households can often find themselves carrying some extra debt as we enter the New Year.

If you happen to be someone currently struggling with some post-holiday debt, that’s okay! Whether you’ve accumulated multiple points of debt from credit cards or are dealing with other loans (such as car loans, personal loans, etc.), you are likely looking for a way to simplify your payments – and reduce them.

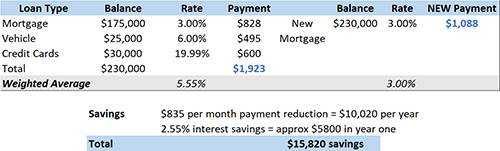

Rolling them into your mortgage could be the perfect solution. In fact, consolidating other forms of debt into your mortgage has multiple benefits, including:

If you’re still not sure if this is the right solution for you, here is an example… if you have $30,000 of credit card debt, you are probably paying approximately $600 per month and $500 per month of that is likely going directly to interest. If you let me help you to roll that debt into your home equity and monthly mortgage, your payment for this $30,000 portion would drop down around $175 per month, with interest charges closer to $140 per month. That is huge savings!

While debt consolidation through refinancing will increase your mortgage, the benefits can be well worth it when it comes to interest savings, time and stress. Keep in mind, you’ll need a minimum of 20 percent equity in your home to qualify for this adjustment.

If you are looking for a way to simplify (or get out of) debt, reach out to me today! I would be happy to take a look at your current mortgage and walk you through the debt consolidation process, or help you come up with an alternative option that may help suit your needs.

General Jag Dhamrait 19 Jan

There has never been a better time for your annual mortgage health check-up! By organizing a quick mortgage review each year, it may yield you some fruitful financial savings.

Your home loan review this year will examine the most common potential monthly savings opportunities, including high-interest credit card debt or fixed loan payments. Reviewing your mortgage terms and options annually could result in having more money left over at the end of each month – and who doesn’t want that?!

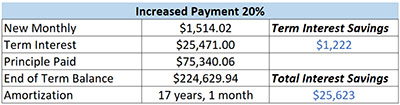

For instance, are you exercising your penalty free extra payment privileges? Do you have any? Prepayment privileges allow you the opportunity to pay up to 20% extra per month and a total of up to 20% lump sum per year – without penalty! This means that for a $300,000 mortgage on a 25-year amortization, a 20% monthly payment increase can generate $18,000 worth of savings AND help you to pay off your mortgage 5 years earlier! When you add-on the annual lump sum of $2,500, the savings are increased to just over $25,000 for the year and bumps you up to being mortgage-free 8 years earlier! You can also use My Mortgage Toolbox app to calculate the potential savings from an extra payment.

|

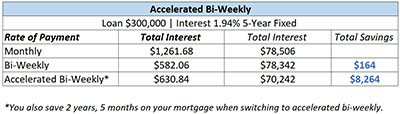

When it comes to mortgage payments, another great question for your annual check-up is whether or not you are on the best payment frequency for your cash flow and to best optimize savings! Most lenders offer various payment frequency and an annual mortgage review can help identify the best frequency based on changing needs and cash flow situations. A monthly payment is simply a single large payment, paid once per month; this is the default that sets your amortization. A 25-year mortgage, paid monthly, will take 25 years to pay off but includes the added burden of one larger payment coming from one employment pay period. Alternatively, an accelerated bi-weekly payment pays your mortgage every two weeks. This frequency allows the mortgage payment to be split up into smaller payments vs a single, larger payment per month. This is especially ideal for households who get paid every two weeks as the reduction in cash flow is more on track with incoming income.

These accelerated bi-weekly payments also offer interest savings, as you are actually making an extra payment each calendar year. For instance, a $300,000 mortgage on an accelerated by-weekly payment schedule will pay off your mortgage two and a half years faster and generate approx. $8,000 in savings!

That’s like getting a $10,000 a year raise just by changing your payment frequency! You can use My Mortgage Toolbox app to also calculate these payment differences.

|

Another area to look at during your mortgage check-up are your penalties. Breaking your mortgage term early, and before the scheduled contract maturity date, will almost always incur a penalty. The amount depends on various factors such as how far you are into the existing term, your current interest and rate type, your existing lender, etc. However, with today’s rates sitting at such a historical low, there can still be savings! Now, if you break your mortgage early and incur a penalty, you can still come out ahead. For instance, it is possible to save $20,000 with a new low rate and incur a $15,000 penalty, which still puts you $5,000 ahead! Having an annual mortgage review can look at these options and determine if it is a benefit for you to chase these historically low rates.

Beyond your current payments and interest rate, consumer debt outside of the mortgage is another important area for review. Did you know? The average Canadian has $30,000 of credit card debt, at approximately 20% interest?! Reviewing your home equity situation could yield $10,000 savings, per year, by rolling debts into your home equity loan. Contact me today to discuss this further and see if it is an option for you!

|

Pay more to save more, pursue lower rates even with a penalty, and debt consolidation are just three examples of the financial savings an annual mortgage check-up with your mortgage professional can do! With interest rates at historic lows, now is the time to investigate all your options and perhaps save yourself thousands of dollars per year, especially if your current interest rate is over 3%! Imagine what you could do with the savings – anything from renovating or investing to going on a much-needed vacation or putting money towards your children’s education.

Completing a straightforward annual review will keep your home financing as lean and trim as possible. In other words, you will have a clean bill of mortgage health, which is just what the doctor ordered!

Contact me, your mortgage agent to set up a mortgage check-up today!

Jag Dhamrait

T: 647-883-7790

E: jag@dlccastle.ca

Latest News Jag Dhamrait 9 Apr

Canada’s bank regulator, The Office of the Superintendent of Financial Institutions (OSFI) announced on April 8, 2021, that it will restart a review of the stress test rate on uninsured mortgages.

If approved, the qualifying stress test rate will move higher from 4.79% to 5.25% or two percentage points above the market rate, whichever is higher.

How does this change by the OFSI impact you?

This change by the OSFI will have a large impact on all borrowers such as first-time home buyers who are already stretching to get into the housing market. Borrowers will have to prove they can get approved for credit products (mortgages, HELOC, etc) at the higher rate which will lower their borrowing power, regardless of what a lender is willing to lend them.

Homebuyers will face these more stringent mortgage stress test measures after June 1, 2021.

Why are these measures being implemented?

These proposed measures will make it harder to qualify for a home loan, which will reduce the pool of qualified borrowers, and ultimately help cool the housing market by bringing down some of the upward pressure on house prices.

Whether you’re a first-time home buyer, refinancing your home, buying an investment property or getting a HELOC (home equity line of credit), this change will affect everyone.

Ironically, those with high incomes and strong credit will continue to accumulate real estate.

OSFI Superintendent Jeremy Rudin said the higher floor rate is based on an average of the qualifying rate in the preceding 12 months leading up to the pandemic, adding that financial markets must be prepared for a return to pre-pandemic conditions—i.e., higher interest rates.

“The main thing we have to be ready for is an increase in mortgage rates to the pre-pandemic range,” he told reporters. “We have interest rates that are extraordinarily low, even by recent standards.”

If you are on the fence about getting into the real estate market, the best time is now. Rates are still relatively low and the new stress test measures have not gone into effect.

Contact me today to see how I can help with your financing needs.